Annual Gift Exclusion 2025

Annual Gift Exclusion 2025. 2025 estate and gift taxes. The 2025 annual exclusion for gifts will be $19,000, up from $18,000 in 2025.

This exclusion allows taxpayers to gift assets to individuals each year. This means you can gift up to $19,000 to each person in your.

2025 Gift Tax Annual Exclusion Anthia Brigitte, Effective january 1, 2025, you will be able to make individual gifts of up to $19,000 in the calendar year (an increase from $18,000 in 2025).

What Is The Gift Tax Limit For 2025 And 2025 Liza Sheryl, In 2025, the annual federal gift tax exclusion has been raised to $19,000.

Annual Gift Exemption 2025 Audrey Mcdonald, Starting january 1, 2025, the annual gift tax exclusion will increase to $19,000 per recipient, up from $18,000 in 2025.

Gift Tax 2025 Limit 2025 Zoe Lyman, The annual gift tax exclusion increases to $19,000 for 2025, up $1,000 from 2025.

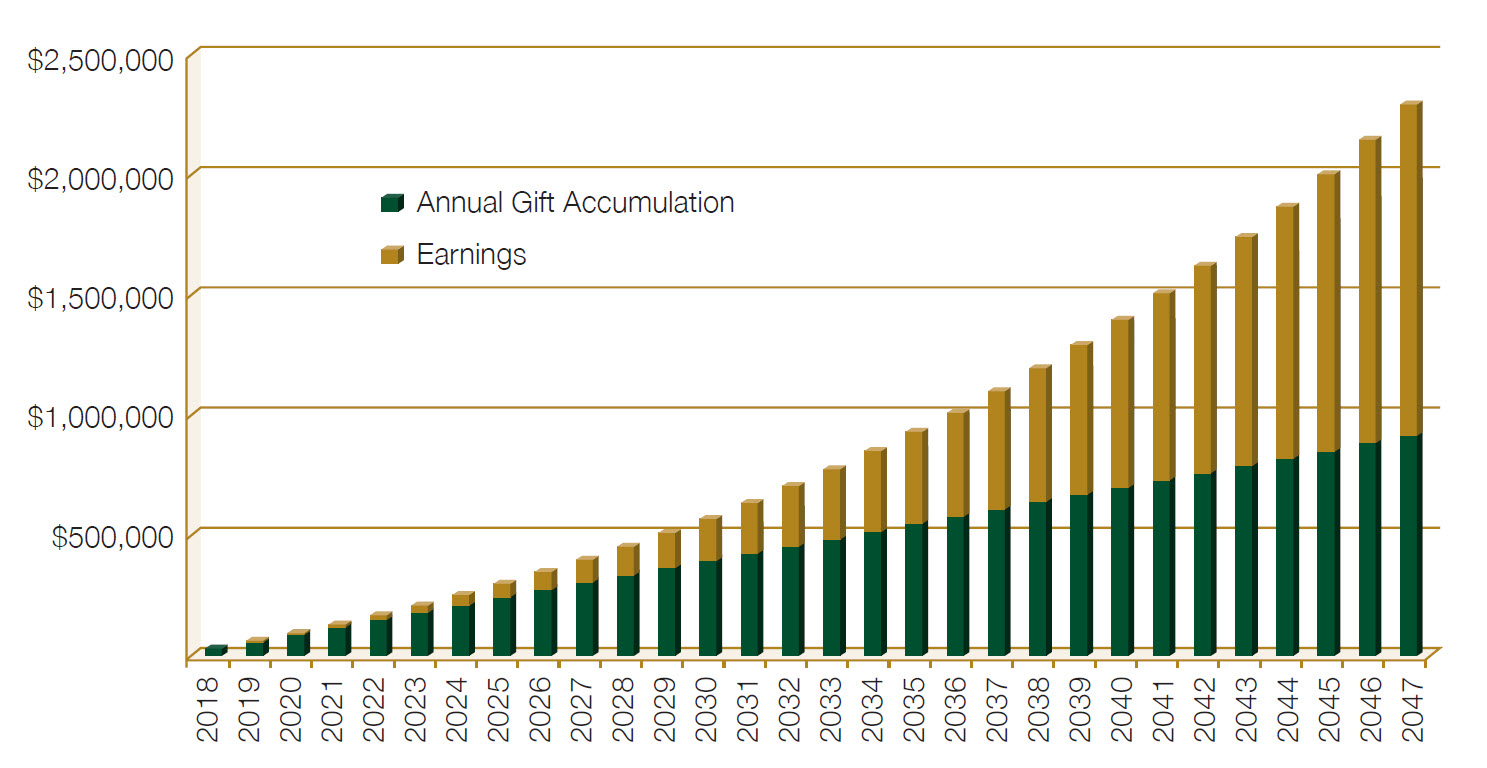

Lifetime Gift Tax Exclusion 2025 Irs Harry Hill, Each year, taxpayers can gift up to what is called the “annual exclusion amount” (in 2025, $19,000 per donor per recipient;

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The gift tax annual exclusion (also simply called the annual exclusion) was also changed in 2025 and will be increased to $19,000.

Annual Gift Exemption 2025 Audrey Mcdonald, Also, for calendar year 2025, the first $190,000 of gifts to a spouse who is not a us citizen.

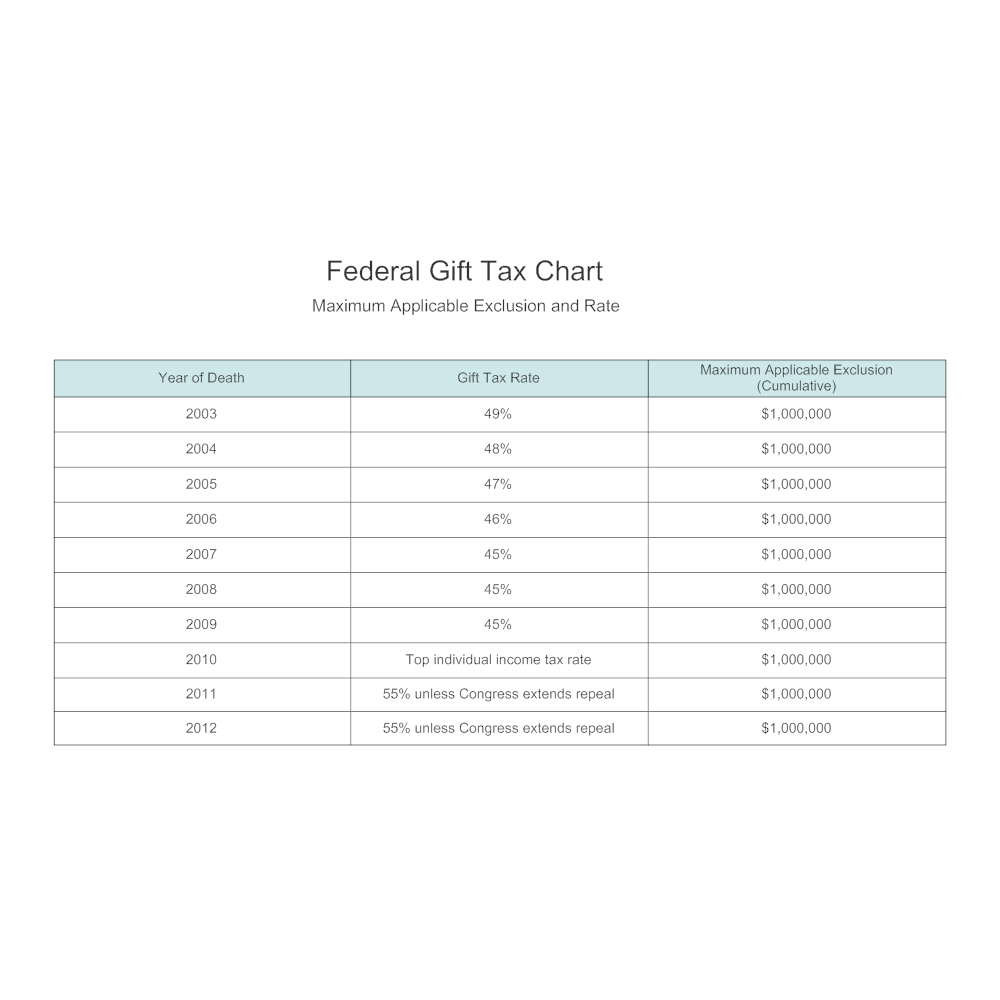

2025 Gift Tax Limit Over 65 Tonye, For 2025, the lifetime gift tax exclusion rises to $13.99 million, up $380,000 from 2025.

Understanding the 2025 Gift and Estate Tax Exemption Changes How They, Married couples may gift up to.