Dependent Care Fsa Income Limit 2025 Over 50

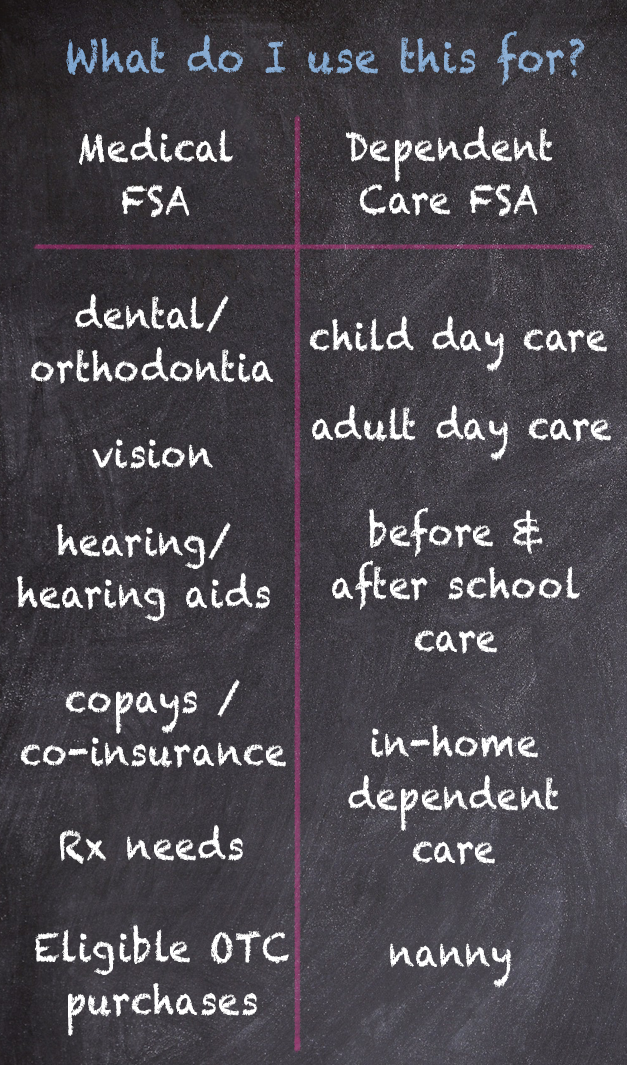

Dependent Care Fsa Income Limit 2025 Over 50. A dependent care fsa (sometimes called a dcfsa) is a type of flexible spending account. A dependent care fsa lets a household set aside up to $5,000 to pay child care expenses for kids under age 13.

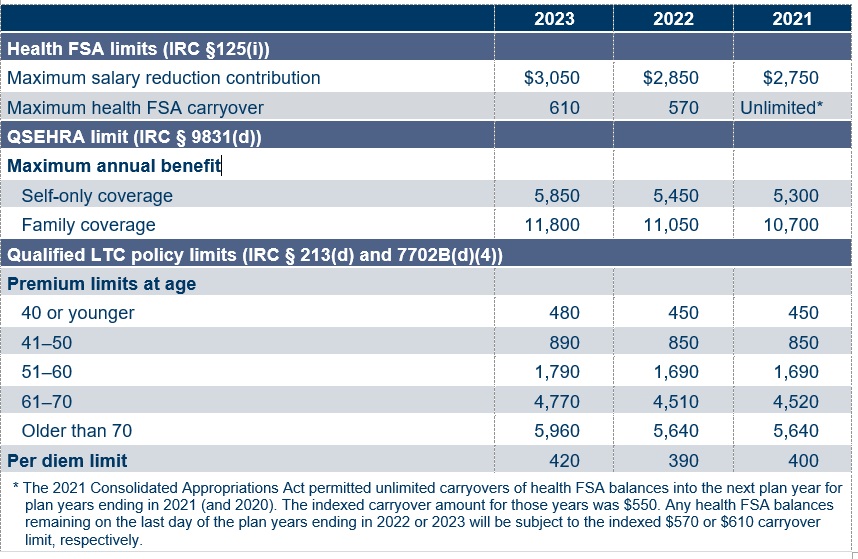

Employers can allow employees to carry over $640 from their medical fsa for taxable years beginning in 2025, which is a $30 increase from 2025. The consolidated appropriations act, 2025 (caa), signed into law at the end of 2025, allows employers that sponsor health or dependent care fsas to permit.

As a reminder, healthcare fsas that permit the carryover of unused amounts, the maximum carryover amount is increased to an amount equal to 20 percent.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, If employer, want to push for an exception since this wasn't flagged as an issue during original enrollment plus i've already contributed ~$1.7k ytd ($1.1k over $575. The fsa contribution limit is going up.

Will Fsa Limits Increase In 2025 Lynn Sondra, The dependent care fsa limit for 2025 is $10,500 for married couples filing jointly and $5,250 for individuals or married couples filing separately. Faqs about the child and dependent care credit expansion due to the arpa.

Dependent Care Fsa Limit 2025 Covid Ericka Deeanne, Dependent care fsa contribution limit 2025 over 50 nessa lurette, the dependent care fsa (dcfsa) maximum annual contribution limit did not change for 2025. The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, There are no changes to dependent. As a reminder, healthcare fsas that permit the carryover of unused amounts, the maximum carryover amount is increased to an amount equal to 20 percent.

Healthcare Fsa Limit 2025 Abbe Jessamyn, The 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households. The higher your income, the lower the percentage you may subtract.

2025 Fsa Hsa Limits Tommi Isabelle, A dependent care fsa (sometimes called a dcfsa) is a type of flexible spending account. The 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households.

Wilhemina Howland, The dependent care fsa limit for 2025 is $10,500 for married couples filing jointly and $5,250 for individuals or married couples filing separately. Dependent care fsa contribution limit 2025 over 50 nessa lurette, on november 9, 2025, the irs released the 2025 health fsa / limited purpose fsa and commuter benefits.

2025 Fsa Contribution Limits Irs Tiffy Tiffie, The fsa contribution limit is going up. In general, as your income increases, the tax credit becomes less valuable while the dependent care fsa.

Dependent Care Fsa Limit 2025 Highly Compensated Employee Engagement, Dependent care flexible spending account calculator. The irs does limit the amount of money you can contribute to a dcfsa each year.

Fsa Approved List 2025 jaine ashleigh, Employers can allow employees to carry over $640 from their medical fsa for taxable years beginning in 2025, which is a $30 increase from 2025. In general, as your income increases, the tax credit becomes less valuable while the dependent care fsa.

For 2025, as in 2025, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and $2,500 for married couples filing separately.