Ga Ad Valorem Tax Calculator 2025

Ga Ad Valorem Tax Calculator 2025. You'll need your vin, vehicle sale date, and georgia residency date to use the ad valorem tax estimator. This comparison can then be.

The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all. However, this retail sales tax does not apply to cars that are bought in georgia.

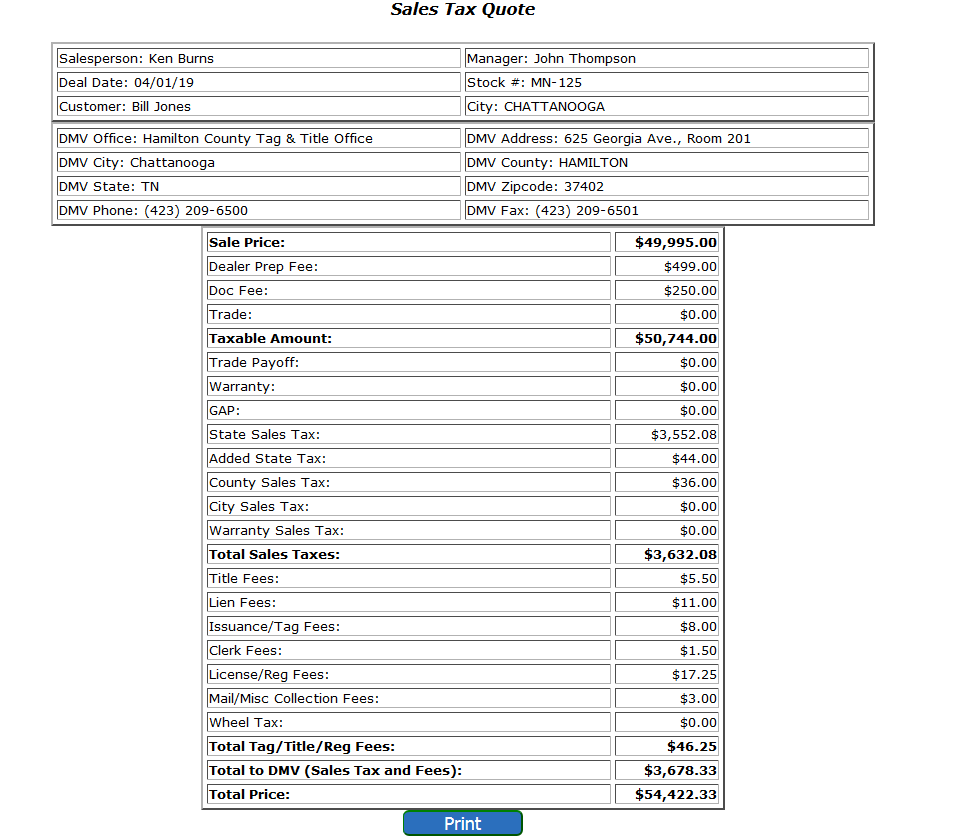

It replaced sales tax and ad valorem taxes (annual motor vehicle tax) and is paid every time vehicle ownership is transferred or a new resident registers the vehicle.

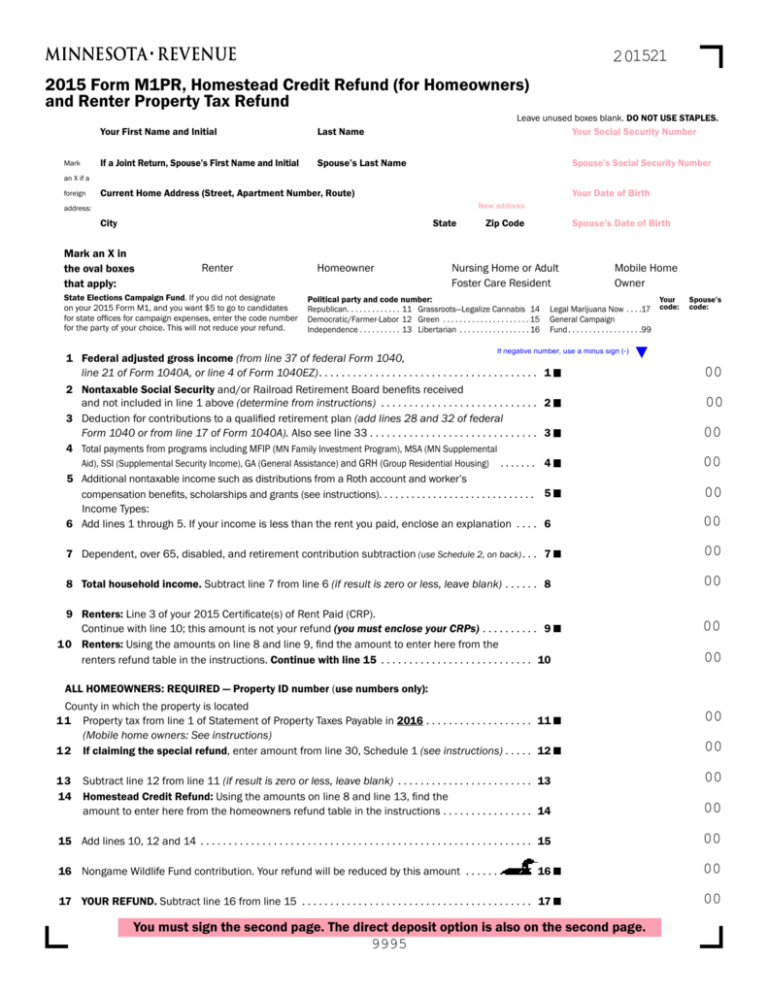

How To Calculate Ga Ad Valorem Tax Tax Walls, Ad valorem tax, more commonly known as property tax, is a large source of revenue for local governments in georgia. Ad valorem tax is a value tax that is assessed annually and must be paid at the time of registration.

Atlanta GA Motor Vehicle Ad Valorem Tax Quick Tax Quote, You can calculate your title ad valorem tax due using the georgia dor's tavt calculator. Property tax is the primary source of revenue for local governments.

ad valorem tax refund Elenora Barlow, Ad valorem tax is a value tax that is assessed annually and must be paid at the time of registration. Instead of paying taxes when you renew your registration, you only.

ad valorem tax trade in Maira Penny, Effective january 1, 2018, georgia house bill 340 requires that the department of revenue (dor) provide two methods of calculating tavt for new, leased vehicles: The basis for ad valorem taxation is the fair market value of.

Ad valorem tax calculator KristenOlaf, The state of georgia has an ad valorem tax which is listed on the motor vehicle registration certificate. Use ad valorem tax calculator.

How Current Dealers Collect Title Ad Valorem Tax and Submit, Payment of ad valorem taxes is a prerequisite to receiving a tag or renewal. You can calculate your title ad valorem tax due using the georgia dor's tavt calculator.

Dealers Title Ad Valorem Tax TAVT and Dealers Annual Ad Valorem, Georgia title attorney explains ad valorem taxes, closing prorations, property tax exemptions and the georgia property tax return. Ad valorem tax, more commonly known as property tax, is a large source of revenue for governments in georgia.

ad valorem tax family member Onerous Ejournal Image Database, The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all. The georgia car tax formula that applies to your vehicle depends on when you buy the car, like before or after 2013.

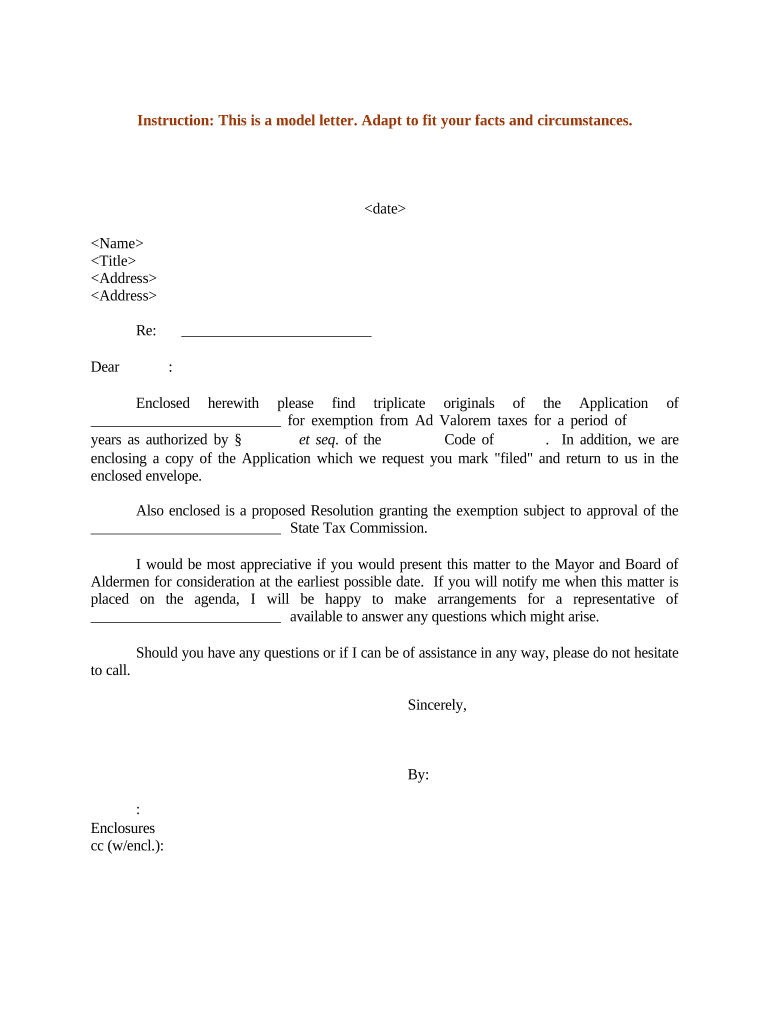

Ad Valorem Tax Form Fill Out and Sign Printable PDF Template SignNow, Ad valorem tax, more commonly known as property tax, is a large source of revenue for local governments in georgia. The state provides two different ad valorem.

ad valorem tax 2025 Madelaine Riggs, The basis for ad valorem taxation is the fair market value. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all.

Ad valorem tax is a value tax that is assessed annually and must be paid at the time of registration.