How Much Medical Expenses Are Deductible 2025

How Much Medical Expenses Are Deductible 2025. • you can only deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (agi), found on line 11. Tax deductions for medical expenses can provide relief for taxpayers.

• you can only deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (agi), found on line 11. Don’t overlook medical tax deductions.

• you can only deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (agi), found on line 11.

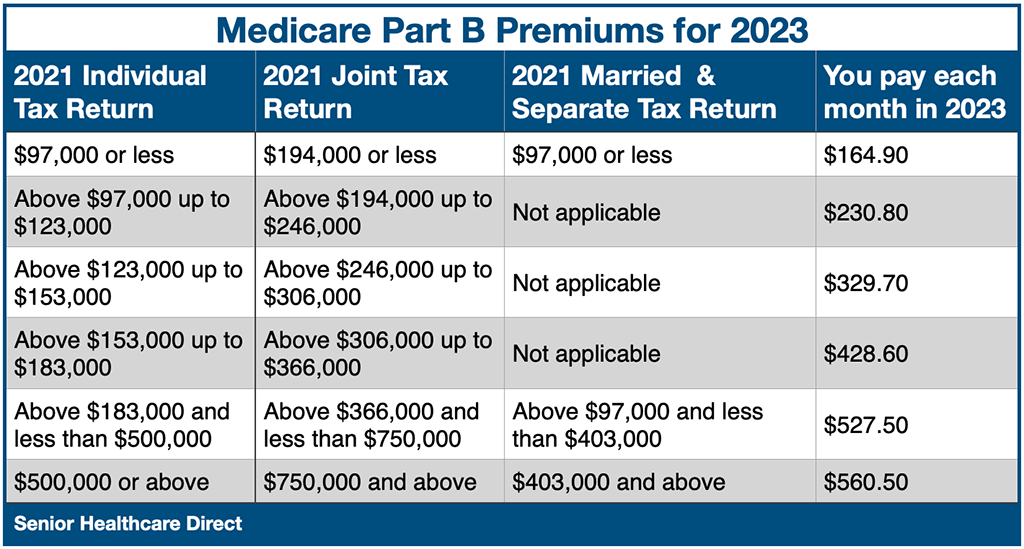

Medical expenses deduction How much can you actually deduct? Marca, The medicare part a deductible in 2025 is $1,632 per benefit period. • the irs allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7.5% of their adjusted.

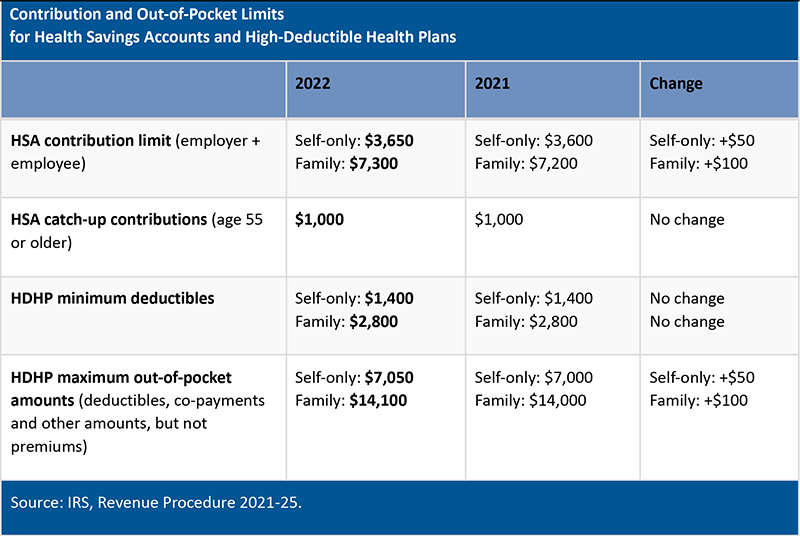

2025 HSA & HDHP Limits, You can claim the total eligible medical expenses minus either 3% of your net income or $2,479, as specified by the cra, whichever is less. You can get your deduction by taking your agi and.

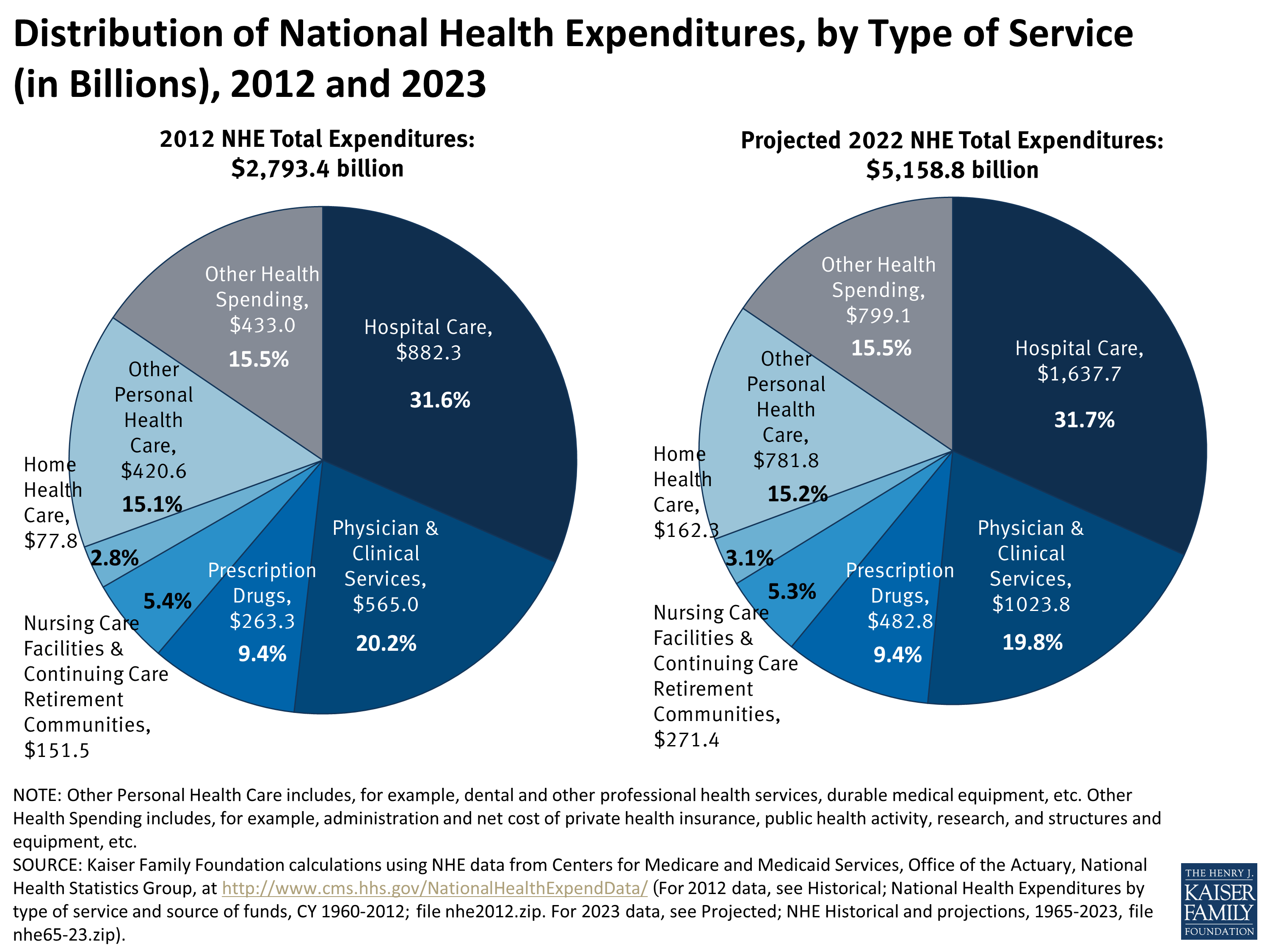

Distribution of National Health Expenditures, by Type of Service (in, You can claim the total eligible medical expenses minus either 3% of your net income or $2,479, as specified by the cra, whichever is less. Roth contributions are not tax.

IRS Announces 2025 Limits for HSAs and HighDeductible Health Plans, You may be able to. Medical expenditure of up to rs 50,000 can also be claimed by a senior citizen provided he/she has no health insurance.

Medicare Costs For 2025 Medicare Hero, Most taxpayers can claim medical expenses that exceed 7.5% of their adjusted gross incomes (agis), subject to certain rules. If you or your spouse is 65 or older, the.

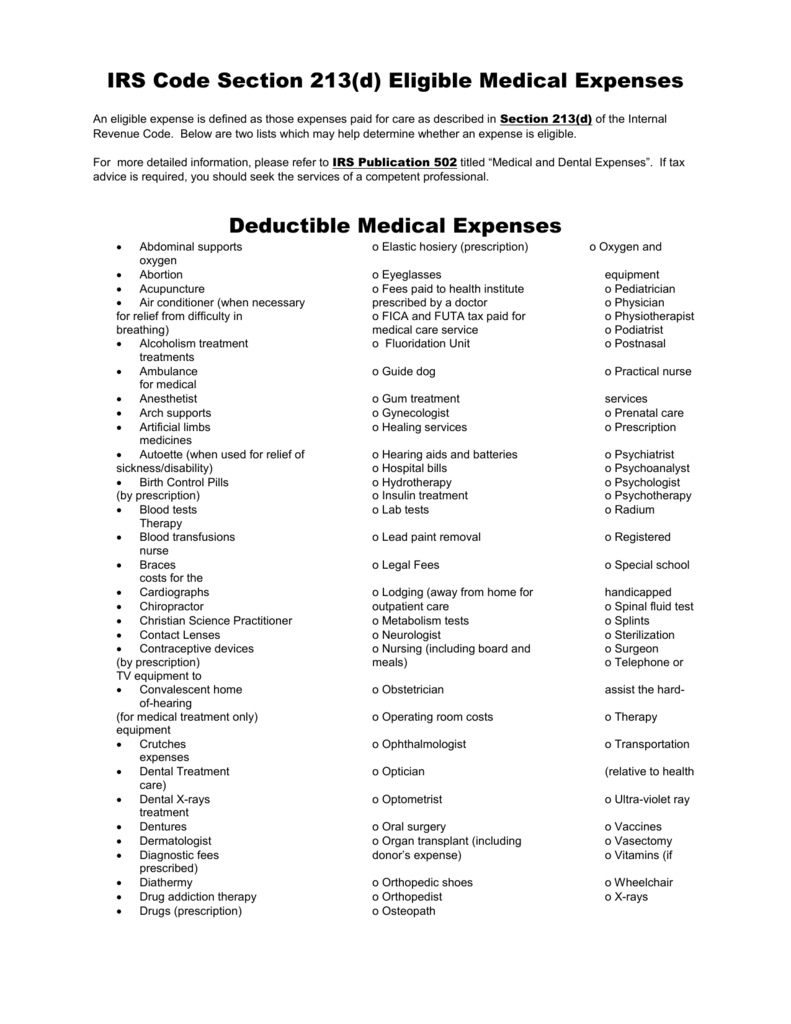

IRS Code Section 213(d) Eligible Medical Expenses Deductible, Medical expenditure of up to rs 50,000 can also be claimed by a senior citizen provided he/she has no health insurance. Qualified medical expenses that exceed a certain percentage of agi.

Claim Medical Expenses on Your Taxes Health for CA, The consolidated appropriations act of 2025 made the 7.5% threshold permanent. What’s the threshold for itemizing medical expenses?

Medicare Cost 2025 Part B Premium and Deductible Decrease Bob’s, Medical expenditure of up to rs 50,000 can also be claimed by a senior citizen provided he/she has no health insurance. For 2025 tax returns filed in 2025, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2025 adjusted.

Qualified Medical Expenses & Health Deductible Plan Tax 2025, You may be able to. You can get your deduction by taking your agi and.

Enhanced Medical Expense Deductions, So, if your agi is $50,000 and your total medical expenses are $5,000, you can deduct $2,500 (the amount which exceeds 7.5% of $50,000). The medicare part a deductible in 2025 is $1,632 per benefit period.

Tiktok Awards 2025. Oppenheimer, barbie, poor things, the zone of interest, and many more. Mar 7, 2025, 12:59 pm pst. Los tiktok awards 2025 premiaron a las mejores historias, personajes, hacks y momentos que nos han cambiado la vida | sala de prensa de tiktok. Ryan gosling slayed his performance of “i’m just ken” at […]

2025 Nba Draft Results. They felt pretty good about him, fowler continued. The nba expands the nba draft to two nights! Follow the 2025 nba draft live, giving you all the nba picks live by round, with draftcast on espn 58 total selections in 2 rounds.

Lpga Q School 2025. Entries will open in early june. Well if it isn't celine boutier back at the top of a leaderboard! Securing their 2025 lpga tour status. Watch lpga now to check out the second round recap.